Managing QuickBooks expenses effectively begins with reviewing your current plan and identifying features you genuinely need. Many users save money by downgrading to a simpler subscription or eliminating unused add-ons. Taking advantage of annual billing, promotional rates, and bundled tools can also help lower long-term costs and further reduce QuickBooks subscription costs. Regularly auditing users, permissions, and connected apps ensures you’re not paying for unnecessary access or integrations. Exploring third-party tools that complement QuickBooks may further reduce expenses without sacrificing functionality. With thoughtful adjustments and periodic reviews, businesses can maintain efficient financial management while keeping subscription costs under control.

Introduction

QuickBooks is a staple for small and midsize businesses, offering extensive features to streamline your financial management. But as subscription prices continue to rise, it’s crucial to proactively seek ways to manage these costs without losing access to the tools you rely on. Whether you’re a long-time user or considering making the switch, there are actionable steps you can take—starting with leveraging options like this QuickBooks coupon code for immediate savings.

With Intuit’s most recent price adjustments, paying attention to how you’re using QuickBooks and what you’re paying for is more critical than ever. Many businesses discover that a few strategic changes can lead to substantial year-over-year savings while maintaining core workflows.

Understand the Recent Price Changes

Intuit increased the pricing of QuickBooks Online and QuickBooks Online Payroll in 2025, citing expanded AI features and enhanced security as the primary drivers. The Simple Start plan, for example, rose from $35 to $38 per month, reflecting an 8.6% rise. Familiarizing yourself with these changes provides a foundation for thoughtful planning as you evaluate your ongoing subscription needs.

Keeping up-to-date on these updates can allow you to catch future price hikes early, so you can either lock in a better deal or prepare for renegotiation—a tactic widely recommended by industry experts, including those at Entrepreneur.

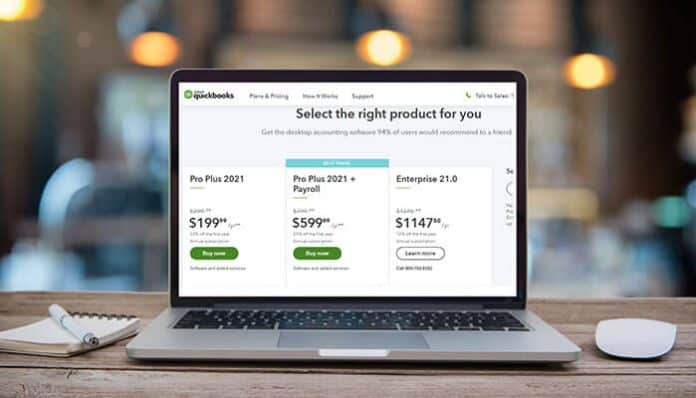

Evaluate Your Current Plan

Start by reviewing the features you actually use. Many businesses opt for higher-tier QuickBooks subscriptions to “future-proof” themselves, only to find they rarely take advantage of the advanced tools. Downgrading to a plan that better suits your workflow can yield significant savings with minimal or no loss of critical features. For instance, if you aren’t using inventory tracking, complex payroll integrations, or advanced analytics, a more basic plan might suffice.

Account for staff and clients who actively use QuickBooks as well. If your usage or employee count decreases, you may be eligible for a more affordable plan. Reassess at least once a year or whenever your team size or business needs shift.

Leverage Promotional Offers

Taking advantage of promotions can dramatically lower your costs, especially if you are a new user or considering a plan switch. For example, in July 2025, Intuit offered a 90% discount on all QuickBooks Online plans for three months, bringing the Simple Start plan down to $3.50 per month. These deals are typically available through QuickBooks directly or through select partners, representing a valuable opportunity to minimize expenses at the outset.

Explore Alternative Solutions

QuickBooks is not the only player in the business accounting market. If your needs shift or you find the subscription costs too steep, platforms like Xero and Zoho Books offer competitive services—often at lower prices. Comparing features, integrations, and customer support among these options can help you find a more affordable solution that aligns with your business goals.

If you’re interested in exploring comprehensive alternatives and how they stack up against traditional accounting software, check out reviews by PCMag for in-depth side-by-side analysis.

Utilize Free Tools and Resources

Enhancing your accounting setup with free external resources can significantly improve efficiency without increasing costs. Many reputable organizations, including the U.S. Small Business Administration, offer no-cost tools, worksheets, and templates for essential financial tasks such as budgeting, cash flow monitoring, and forecasting. By utilizing these resources in conjunction with your accounting software, you can minimize your reliance on higher-tier QuickBooks features or paid add-ons. This not only helps keep your subscription level manageable but also strengthens your financial planning process. Leveraging these complementary tools creates a more balanced, cost-effective strategy that supports informed decision-making and long-term business stability.

Monitor and Adjust Usage

Periodically examine your QuickBooks usage and audit the features and add-ons you’re paying for. Many users unknowingly keep unused modules or premium integrations, quietly inflating monthly costs. Streamlining your setup can yield immediate reductions. Likewise, invest in staff training—effective use of the software prevents accidental upgrades or the purchase of unnecessary features.

Seek Member Discounts

Many industry groups, financial organizations, and credit unions provide special QuickBooks subscription discounts as part of their member benefits, making them a valuable yet often overlooked resource for reducing costs. These partnerships can offer significant savings, such as BECU’s 30% discount during the first six months of a membership. Similar deals may be available through professional associations, chamber of commerce memberships, or small-business networks to which you already belong. Taking a few minutes to review these affiliations can reveal significant cost savings. It’s an easy, low-effort strategy that lets you maintain full QuickBooks functionality while keeping expenses more manageable for your business.

Stay Informed About Industry Trends

As cloud-based accounting solutions become the norm, new offerings, such as QuickBooks Money, have entered the market. These alternatives often provide payment and banking services with no monthly fees—a promising option for businesses seeking to streamline operations and avoid ongoing subscription charges. Keeping an eye on these trends ensures that you stay ahead of industry shifts and are prepared to pivot to cost-effective solutions as they emerge.

Conclusion

Rising QuickBooks subscription costs don’t have to erode your bottom line. By staying informed, evaluating your real needs, utilizing promotions and member discounts, and regularly monitoring your software usage, you can strategically manage and reduce your QuickBooks expenses. Each small step—whether it’s downgrading your plan, adopting free tools, or even switching software—adds up to meaningful savings while keeping your business finances under control.